Today’s financial investors have access to almost limitless amounts of information at their fingertips to help inform their trading decisions. Identifying support and resistance points in the financial markets is something hedge fund and even individual day traders now take for granted. Technological advancements in trading technology have changed the face of the stock market in the digital age, helping to provide improved liquidity that generates much-needed value for companies and their shareholders.

Whether you’re a seasoned investor in the digital age or just looking to dip your toe into the stock market in 2019, let’s take a look at some of the biggest technological impacts that have changed the way 21st-century investing works.

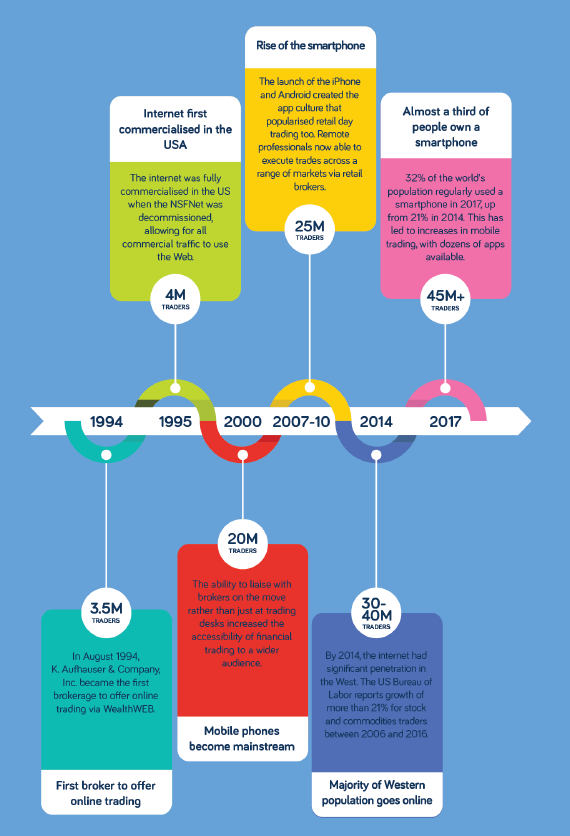

Mobile phones enter the mainstream

On the eve of the millennium, mobile phones became commonplace on trading desks around the world. The ability to liaise with brokers on the move as opposed to solely at trading desks increased the accessibility of financial trading to a wider audience. The release of the first true ‘smartphone’, the Apple iPhone – along with Android-powered devices – created the app culture that popularised retail day trading. Apps such as the award-winning IG.com trading app now allow retail traders to access 15,000+ markets on the go anywhere they have a 4G or Wi-Fi connection.

Cloud-based trading terminals

The very first computerised trading terminals reared their head in the mid-1960s, developed by Ultronics and Scantlin Electronics. For the first time, trading analysts had the ability to request stock quotes using ‘hot keys’ that provided more information at analysts’ fingertips than ever before. It’s a little more sophisticated today, with the likes of Reuters using cloud-based trading terminals that any investor can download to access real-time market news and pricing – for a cool price of $20,000 per annum, of course.

Big data

The internet and today’s technologies have made it possible to collate data on an unprecedented scale. Agencies such as the SEC utilise data to assess market behaviours and pinpoint possible illegal or insider trading activity. Hedge funds and retail traders also use big data to get a feel for market sentiment and use past data to predict future moves.

Algorithmic trading

Algorithms have made it possible for hedge funds and the biggest banks to trade with unrivalled precision and speed. Algorithmic trading sees bots utilised to execute trades when a plethora of scenarios occur, based around trading volumes, volatility and time. Algorithms can operate without the mental bias of a human trader.

What could the future of financial trading technology look like?

Blockchain trading

There is a widely held belief that blockchain-based trading ledgers will be the next addition to the financial markets, helping to automate the settlement, audit and confirmation of trades and transactions in the market.

Tool-based execution of trades

Even by the end of 2013, almost a third of all share trades were executed on mobile devices, according to CommSec’s Richard Burns. Trading could soon be 100% mobile, with no need for terminals or trading floors.

Quantum-sealed envelopes

Given the threat of cybercrime, quantum-sealed envelopes are being designed to help safeguard financial markets from digital fraud.

First published: 18 January 2019, 12:10 IST