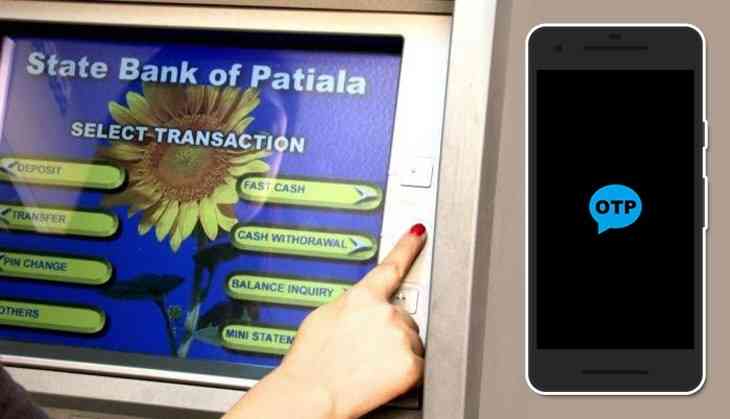

State Bank of India has announced new rules for cash withdrawal from SBI ATM. The country’s largest lender will be introducing a one-time password (OTP) cash withdrawal system that will help its customers from illegal transactions at ATM. This new change will come as a boom for SBI customers that will come in effect from January 1, 2020, between 8 pm to 8 am.

Sharing details about the new rule, SBI took to Twitter and wrote, "Introducing the OTP-based cash withdrawal system to help protect you from unauthorized transactions at ATMs. This new safeguard system will be applicable from 1st January 2020 across all SBI ATMs.

Introducing the OTP-based cash withdrawal system to help protect you from unauthorized transactions at ATMs. This new safeguard system will be applicable from 1st Jan, 2020 across all SBI ATMs. To know more: https://t.co/nIyw5dsYZq#SBI #ATM #Transactions #SafeWithdrawals #Cash pic.twitter.com/YHoDrl0DTe

— State Bank of India (@TheOfficialSBI) December 26, 2019

Notably, this facility will be applicable for transactions above Rs 10,000.

Know SBI OTP-based cash withdrawal facility:

1) During transactions from ATM, the customer will receive an OTP on their registered mobile number with the bank.

2) No other facility will be changed in the present process to withdraw cash from SBI’s ATM.

3) The new facility of SBI will not apply to other bank’s ATM because National Financial Switch doesn’t develop this facility.

4) Once the cardholder enters the value which he/she desires to withdraw, then an OTP will display on the screen.

5) SBI customers will have to enter the OTP received on his mobile number registered with the bank on this screen for getting the cash.

Also Read: Alert! SBI to block your ATM card after December 31; read details

First published: 27 December 2019, 14:32 IST