Yes, microlending reduces extreme poverty

A small boost in microlending to the developing world could lift more than 10.5 million people out of extreme poverty. That’s one conclusion of my study, published last month in The B.E. Journal of Macroeconomics, which found that microfinance not only reduces how many households live in poverty but also how poor they are.

Currently, 836 million people – or 12% of the world’s population – experience extreme poverty, living off less than US$1.25 a day. Using data from 106 developing countries from between 1998 and 2013 to examine the efficacy of microlending as a poverty-reduction tool, I found that just a 10% increase in the gross microfinance loan portfolio per client could cut this number by 1.26%.

While the world has seen some progress over the past 15 years in reaching the UN Millennium Development Goals (MDGs), which placed eradicating hunger and poverty on top of the global agenda, extreme poverty remains a pressing challenge. It continues to be a priority in the 2015-2030 Sustainable Development Goals.

K Paul Thomas of @ESAFMicrofin says mission to end extreme poverty remains unchanged as they continue to... https://t.co/neFw9UaNbz

— Microcredit Summit (@MicroCredSummit) April 29, 2016

By 2015, the proportion of the world’s population living in extreme poverty had dropped to 14% from 50% in 1990, according to the MDG Monitor. But in Sub-Saharan Africa, more than 40% population continues to live on less than US$1.25 a day. And extreme poverty appears to have increased in Western Asia.

Poverty may have retreated, but it clearly remains a force in people’s lives.

Microfinance and poverty reduction

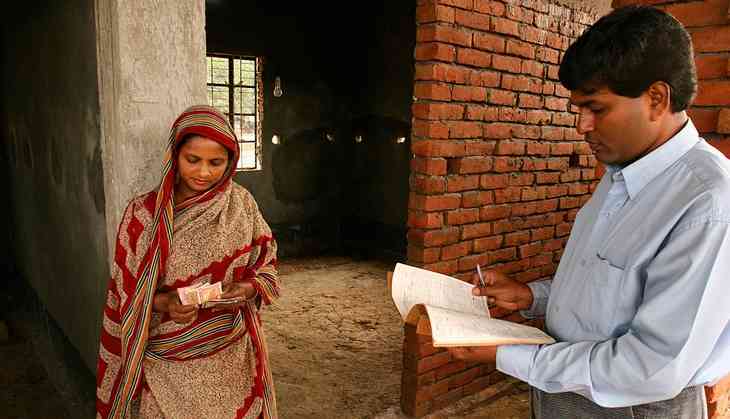

The practice of giving small loans (as little as US$10 or as much as $US500) to the very poor, alongside other financial services such as savings accounts and financial training, was the brainchild of economist Mohammad Yunus.

In the 1970s, he began offering credit to poor women in the village of Jobra, Bangladesh, so that they could launch income-generating projects to help support themselves and their families. In 2006, those experiments won Yunus and his microcredit-focused Grameen Bank a Nobel Peace Prize.

Since then, various forms of microlending programs have been introduced in many countries, from India to the United States. According to a 2015 report from advocacy organisation Microcredit Summit Campaign, by 2013, some 3,098 microfinance institutions had reached over 211 million clients worldwide, just under half of whom were living in extreme poverty.

In 2017, the market for microfinance investments in micro, small and medium enterprises, as well as the provision of financial services to those businesses, is projected to grow by an average of 10% to 15%. Even stronger growth is expected in India and the Asia-Pacific region.

Access to credit enables poor people to become entrepreneurs, increasing their earnings and improving their quality of life. Many lenders accompany their small loans and financial services with peer support, networking opportunities and even health care to improve their clients’ odds of building a successful small business.

In doing so, many economists submit, they show that microfinance has a powerful potential to reduce poverty.

But evidence that microfinance actually works is mixed. Studies examining its impact in rural Pakistan, urban Kenya and Uganda, among other developing countries, have both confirmed and contradicted the premise of Mohammud Yunus’s innovation.

Evidence from around the world

My study aimed to make sense of this inconclusive evidence, taking a macroeconomic approach that pulls information from many countries together to provide a clearer picture.

Officially, poverty is measured using two World Bank indicators: the poverty headcount ratio (which measures the percentage of the population living below the US$1.25 a day mark) and the poverty gap (which assesses how far below that line people fall, on average, and is expressed as a percentage).

The key variable of significance in my analysis is participation in microfinance programs. I defined this in two ways for each country studied: the proportion of total clients as a share of national population, and the average size of loan (gross loan portfolio over total clients), using microfinance data from the Microcredit Summit Campaign and MIX Market), a microfinance auditing firm.

What I found was a negative relationship between microfinance participation and poverty, meaning that the more people in a given country received small loans, the less poverty it registered. Thus, in the average developing nation, an increase in the gross loan portfolio per client by just 10% could reduce the extreme poverty rate by 0.0126 percentage points.

I also found that microfinance reduces the depth of poverty, shrinking the gap between a person’s daily budget for living and the current US$1.25 per day definition of extreme poverty (the non-poor have a 0% shortfall).

Policy implications

Microfinance is no panacea. Numerous studies have shown that country-specific and cultural factors are determinants in how microfinance will interact with poverty, and there are occasionally devastating tales of failure in which the inability to repay a very small loan has plunged households further into desperate penury.

Access to finance can be a very effective way out of #poverty. -@JimYongKim #WomensEconomicEmpowerment #HLP #UNGA pic.twitter.com/mZRznDx2CJ

— World Bank (@WorldBank) September 22, 2016

![]() Overall, however, my study suggests that more microcredit would benefit poor countries. National governments and international development agencies can continue to promote microfinance as a tool for reducing poverty, while bearing in mind the limitations of any single strategy in tackling an entrenched global problem.

Overall, however, my study suggests that more microcredit would benefit poor countries. National governments and international development agencies can continue to promote microfinance as a tool for reducing poverty, while bearing in mind the limitations of any single strategy in tackling an entrenched global problem.

Quanda Zhang, PhD Candidate and Researcher in Economics, RMIT University

This article was originally published on The Conversation. Read the original article.

First published: 26 June 2017, 17:18 IST