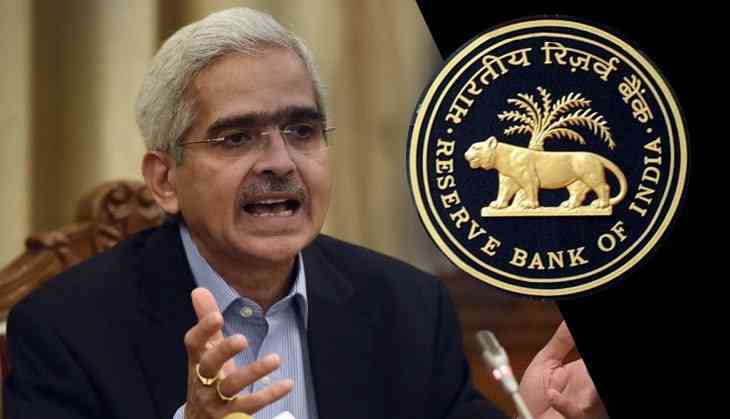

The Reserve Bank of India (RBI) governor Shaktikanta Das is expected to announce crucial police during the bi-monthly monetary policy address on Thursday. It is being seen whether or not the RBI governor will announce interest rate cut to back the economy in view of inflation.

RBI Monetary Policy Committee is expected to keep its policy outlook accommodative when it puts out the decision of the committee on Thursday. Pundits are of the opinion that the MPC will keep the rates unaltered and that a cut would come when you are least expecting it.

According to chief India economist at Deutsche Bank AG in Mumbai, Kaushik Das, the RBI governor has not long ago shifted his focus towards the fragile financial sector in the midst of forcasts for a sharp climb in bad loans. Those concerns could override inflation risks and lead to a rate cut.

A review run by HT’s Mint displayed that six from ten bankers believe the RBI to keep the repo rate on hold at 4 %, while others reckon a 25 basis point cut.

A poll of 42 economists conducted by Bloomberg showed that economists were divided with 21 ecpecting a 25 basis point cut and 20 prophesying a stop.

The RBI targets to maintain inflation within 2 % - 6 %, however consumer price growth has exceeded the upper end of that band for most of the past two quarters. As maintained by Bloomberg's report, the MPC may reconsider its forecasts higher.

Apart from this, investors are looking for certainty that liquidity will be in excess and that the RBI continues its secondary market bond purchases and provide curve control measures to absorb a record government borrowing program.

Also Read: Equity indices jump 3% ahead of RBI Governor's address