The BJP government has finally presented its 6th and final budget ahead of the 2019 Lok Sabha polls and the most talked about change has been the tax rebate provided by the Piyush Goyal’s Finance Ministry to the salaried class under Rs 5 lakh income.

The interim Finance Minister, while presenting the budget in parliament said, “For the present, the existing rates of income tax will continue for FY 2019-20 also. I propose the following changes – Individual taxpayers having annual taxable incomes up to Rs 5 lakh will get full tax rebate.”

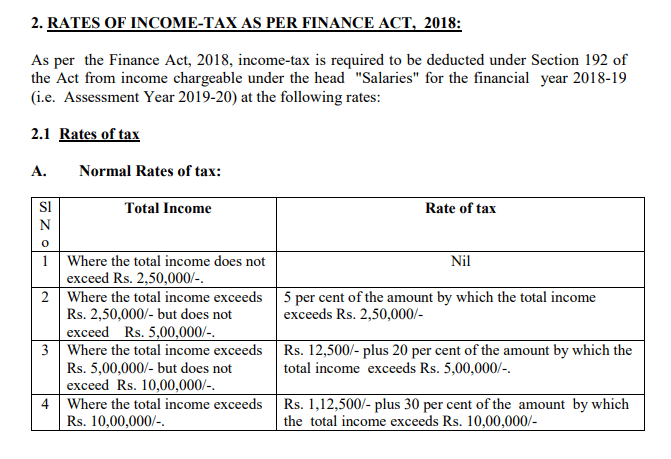

This clearly indicates that the BJP government has NOT proposed to change any tax slabs where the exempt category still lies with under Rs 2.5 lakh. For the salaried class of under Rs 5 lakh and above Rs 2.5 lakh, the government has decided to give them tax rebate and not tax exemption as both phenomena are different and altogether effects differently to the pocket of middle man.

As per current tax slab rules, laid down by the Income Tax department, individuals with annual salary of less than Rs 2.5 lakh remain exempted from paying any taxes. But, those individuals who have earn between Rs 2.5 lakh and Rs 5 lakh used to pay a tax of 5%. For e.g if the income of an individual is Rs 3.5 lakh annually, then he/she will have to pay 5% tax on the extra amount of Rs 1 lakh.

‘Tax Exemption is the income, expenditure and investments on which no tax is levied. As per the Indian tax system, individuals earning up to Rs 2.5 lakh are exempt from paying taxes.’

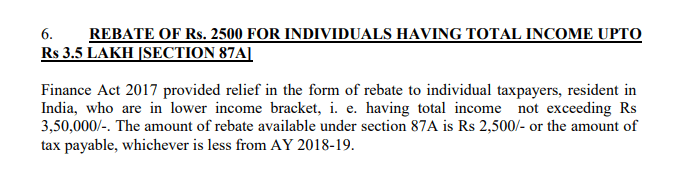

‘Tax Rebate on the other hand, is a relief provided to taxpayers in the form of a refund on taxes already paid to the government. Section 87A of the Income Tax Act provides a rebate of Rs 2,500 or the tax payable (whichever is lower) for individuals with total income not exceeding Rs 3.5 lakh.’

Now, the BJP government has proposed a change in the Section 87A and Piyush Goyal has recommended a full rebate on tax payers earning up to Rs 5 lakh annually. This clearly means that the tax payers can get a rebate of Rs 12,500, ie 5% of Rs 2.5 lakh.

Now, as per news website Alt News, “The interim finance budget does not propose any changes in tax slabs but expands the scope of tax rebate (Rs 12,500 from Rs 2,500) and standard deduction (Rs 50,000 from Rs 40,000). If these proposals are accepted in the parliament, individuals with taxable income of up to Rs 5 lakh would still need to pay taxes but can avail reliefs at the time of filing IT returns.”

First published: 2 February 2019, 10:29 ISTStandard tax deduction for salaried persons raised from 40,000 rupees to 50,000 rupees: FM Shri Piyush Goyal #Budget2019 https://t.co/bwq6afFrrs

— PIB India (@PIB_India) February 1, 2019