Why Jaitley’s ‘mega stimulus’ for public sector banks is unlikely to revive economy

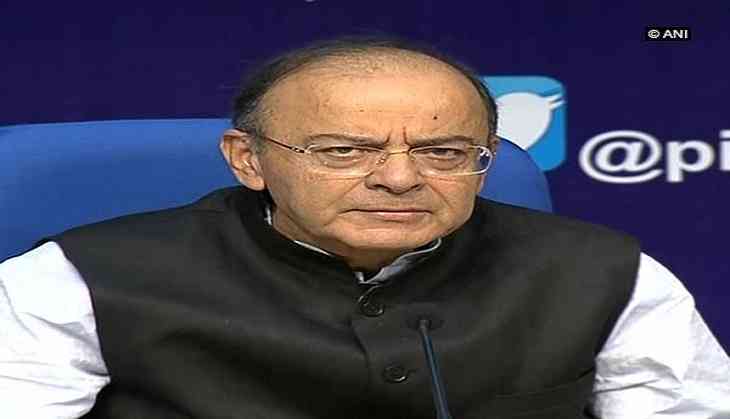

Facing criticism over the declining economic growth in India, finance minister Arun Jaitley on Tuesday came up with a mega recapitalisation plan for the public sector banks (PSBs).

The plan involves a fund infusion of Rs 2.11 lakh crore in the banking system as part of government equity to help them tide over capital shortfall crisis. It also includes the assurance of creating more jobs through investment in the infrastructure sector.

The Rs 2.11 lakh crore of recapitalisation will include an infusion of Rs 135 lakh crore through front loaded ban to recap bonds and Rs 76,000 crore from budgetary support and market loans.

The announcement was made as an assurance to critics of the government and markets that the government is serious about addressing the current slump in economic activity that has pulled down India's economic growth rates to a 3 year low of 5.7%.

In an hour-long presentation made with the help of seven top finance ministry officials, Jaitley tried to explain the current slump in economic growth and assured a steady growth trajectory for the future by showcasing a number of economic indicators like lower current account deficit, declining inflation, rise in forex reserves and infrastructure expenditure.

“A part from the banks recapitalisation package, the rest of the presentation was a sort of a repeat of the Budget-day presentation made earlier this year,” said a private sector infrastructure expert who did not want to be quoted on the subject.

Will this stimulus be enough?

The banking sector woes are just a part of the problem that the Indian economy faces today. There are non-performing assets worth around Rs 8.35 lakh crore in the banking sector and this has reduced the lending capacity of public sector banks.

While experts appreciated the move by the government to recapitalise PSBs they also questioned the government's ability to do it within the current fiscal deficit framework.

The finance minister, on the other hand, was not willing to clarify the impact this recapitalisation will have on government expenditure.

The government has set a fiscal deficit target of 3.2% for the current fiscal. However, any amount of money promised to banks through bond issuance, will have to be added to the government borrowings as per the Indian accounting standards.

Apart from this, there are also concerns whether the banks would be willing to lend out money to the same corporate houses that have failed to service their old debt over the past 5 years.

NC Saxena, former member secretary of the erstwhile Planning Commission, said that the banking sector is just part of the problem. There are various other issues that mar the Indian economy. The government's push for the infrastructure sector is good but it will have to ensure lower interest rates and land availability for those projects”.

Apart from fund-infusion, Jaitley also said that the government plans to introduce banking reforms that will ensure that there is no rolling over of bad loans for years as happened in the period between 2008 and 2014.

However, he did not reveal the details of the plan.

A large part of the government's ability to push economic growth now depends on its ability to meet its revenue receipts targets.

The government has set up an ambitious target of raising Rs 72,500 crore from divestment in the public sector units. Though, a report by State Bank of India's research unit says that the government’s revenue receipts may fall short by Rs 1.1 lakh. However the same SBI report bets on government meeting its fiscal deficit target of 3.2%, by way of expenditure cuts- something that the grand plans of recapitalising the public sector banks may not allow.

First published: 24 October 2017, 21:22 IST